About The Online Accounting Fundamentals Certification

Accounting careers are booming and the demand for accounting professionals currently exceeds supply. If you're interested in increasing your financial awareness and accountability while also gaining a marketable skill, this instructor led online accounting course is for you.

This course covers all the bases, from writing checks to preparing an income statement and closing out accounts at the end of each fiscal period. Suitable for either a small business or an individual household, this course is sure to increase financial awareness and accountability.

Why Get Certified?

Undergoing a professional certification is certainly very beneficial for job and work prospects. Showing that you have been certified gives confidence to clients and hiring managers that you possess the essential knowledge and skills to get the job done.

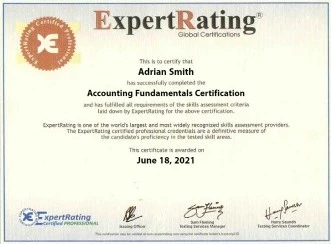

This certification comes with everything you need including an in-depth online courseware with plenty of examples and expert tips. The course usually takes 2-4 weeks to complete, after which you can take the online test from your own device. You will receive an online transcript and a certificate. We also provide highly responsive feedback to hundreds of employee verification requests annually. Taking this certification could be the smartest move for your career.